For decades, AT&T (T) has been a cornerstone of the telecommunications industry, providing essential services to millions of consumers and businesses. Beyond its core operations, the company has also garnered a reputation as a dividend-paying stalwart. This article delves into the intricacies of the T dividend, exploring its history, current status, investor implications, and the factors influencing its future trajectory.

A Legacy of Dividend Payments

AT&T boasts a rich history of rewarding shareholders with consistent dividend payments. The company’s commitment to returning value to investors has solidified its status as a Dividend Aristocrat, a prestigious title reserved for S&P 500 companies that have increased their dividends for at least 25 consecutive years.

The Power of Dividend Growth

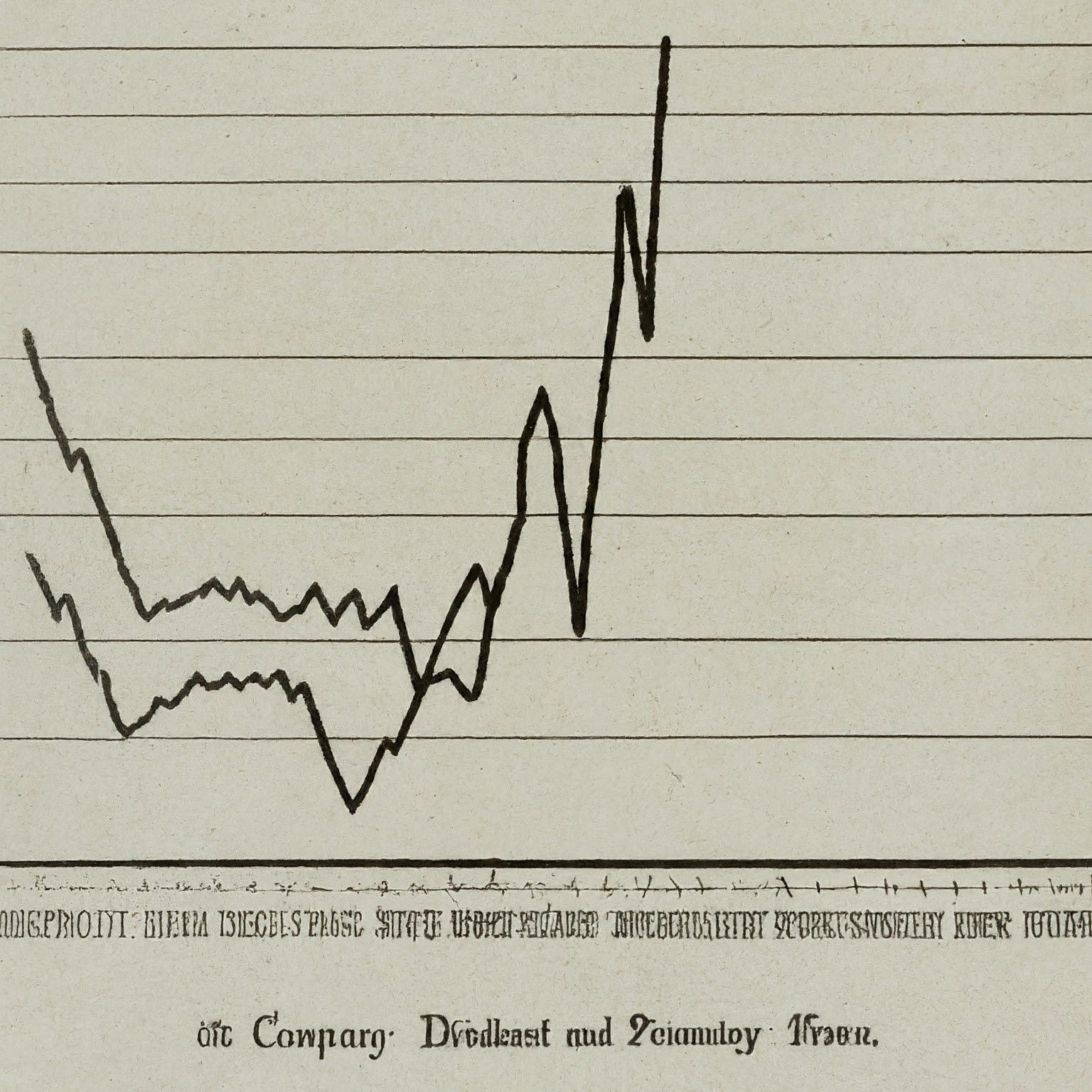

One of the most compelling aspects of the T dividend is its history of growth. While the pace of increases may have varied over the years, AT&T’s dedication to enhancing shareholder returns through dividend growth has been a hallmark of its financial strategy.

Understanding the T Dividend

To fully appreciate the significance of the T dividend, it’s essential to grasp key metrics and terminology:

- Dividend Yield: This represents the annual dividend per share divided by the stock price, expressed as a percentage.

- Dividend Payout Ratio: This measures the proportion of earnings distributed as dividends to shareholders.

- Dividend Growth Rate: This indicates the annual increase in the dividend per share.

- Ex-Dividend Date: This is the date on which a stock starts trading without the dividend included in its price.

Factors Influencing the T Dividend

Several factors contribute to AT&T’s dividend policy and its potential future trajectory:

- Financial Performance: The company’s earnings, cash flow generation, and overall financial health are paramount in determining dividend sustainability and growth.

- Industry Dynamics: The competitive landscape of the telecommunications industry, technological advancements, and regulatory changes can impact AT&T’s financial performance and, consequently, its dividend.

- Capital Allocation: AT&T’s strategic priorities, including investments in network infrastructure, mergers and acquisitions, and share repurchases, compete for capital alongside dividend payments.

- Investor Sentiment: The market’s perception of AT&T’s dividend policy and its overall investment thesis can influence the stock price and investor demand.

The T Dividend in the Context of Investment Strategies

The T dividend holds particular appeal for different types of investors:

- Income-Oriented Investors: Dividend-focused investors often gravitate towards AT&T due to its consistent and growing dividend.

- Retirement Investors: The reliability of the T dividend can be a valuable component of retirement income planning.

- Dividend Growth Investors: While AT&T’s dividend growth rate may not be as aggressive as some other Dividend Aristocrats, it can still contribute to long-term wealth accumulation.

Challenges and Opportunities

Like any company, AT&T faces challenges that could potentially impact its dividend. Intense competition, regulatory hurdles, and technological disruption are among the headwinds. However, the company’s strong brand, extensive customer base, and diversified revenue streams provide a solid foundation for future growth and dividend sustainability.

Conclusion

The T dividend has been a cornerstone of AT&T’s investment thesis for decades. While the company’s focus on dividend growth may have shifted in recent years, its commitment to returning value to shareholders remains evident. As the telecommunications landscape continues to evolve, investors will closely monitor AT&T’s financial performance and strategic decisions to assess the long-term prospects of the T dividend.