AT&T, a behemoth in the telecommunications industry, has been a cornerstone of the American landscape for over a century. As a publicly traded company, its stock performance has been a subject of keen interest for investors. This article delves into the intricacies of AT&T stock, exploring its historical performance, underlying factors influencing its value, and potential future trajectories.

Understanding AT&T as a Company

Before diving into the specifics of AT&T stock, it’s crucial to understand the company’s business model. AT&T is a diversified conglomerate with a strong foothold in telecommunications services, including wireless, broadband internet, and pay-TV. The company has undergone significant transformations in recent years, including the spin-off of WarnerMedia to form Warner Bros. Discovery.

Historical Performance of AT&T Stock

To gauge the potential of AT&T stock, examining its historical performance is essential. The telecom industry has undergone substantial changes, influenced by technological advancements, regulatory shifts, and economic cycles. Analyzing AT&T stock‘s trajectory over the years can provide valuable insights into its resilience and adaptability.

- The Telecom Boom: During the dot-com era, AT&T stock experienced significant growth as the demand for telecommunications services surged.

- The Financial Crisis: The 2008 financial crisis impacted AT&T stock negatively, as it did many other companies. However, the company’s diversified business model helped mitigate the impact.

- Recent Transformations: AT&T’s decision to spin off WarnerMedia marked a significant strategic shift. The impact of this decision on AT&T stock is a key area of analysis.

Factors Influencing AT&T Stock Price

Several factors contribute to the fluctuations in AT&T stock price:

- Industry Trends: The broader telecommunications industry is subject to rapid technological advancements and regulatory changes. These factors directly impact AT&T stock performance.

- Competitive Landscape: Competition from other telecom giants like Verizon and T-Mobile influences AT&T stock as investors assess the company’s market share and competitive advantage.

- Economic Conditions: Economic downturns can affect consumer spending on telecommunications services, impacting AT&T stock. Conversely, economic expansions can drive growth.

- Dividend Yield: AT&T has a history of paying dividends, which can attract income-oriented investors. Changes in dividend policy can influence AT&T stock price.

- Debt Levels: The company’s debt-to-equity ratio is a crucial factor for investors, as high debt levels can increase financial risk.

Analyzing AT&T Stock: Key Metrics

To make informed investment decisions, investors should consider the following key metrics:

- Price-to-Earnings (P/E) Ratio: Compares the company’s stock price to its earnings per share. A lower P/E ratio may indicate a potentially undervalued stock.

- Dividend Yield: Measures the annual dividend paid per share relative to the stock price. A higher dividend yield can be attractive to income-oriented investors.

- Debt-to-Equity Ratio: Indicates the company’s financial leverage. A lower ratio suggests a stronger financial position.

- Free Cash Flow: Represents the cash generated by a company’s operations after deducting capital expenditures. Positive free cash flow is generally considered favorable.

Potential Future Outlook for AT&T Stock

Predicting the future performance of AT&T stock is challenging due to the dynamic nature of the telecommunications industry. However, several factors can influence its trajectory:

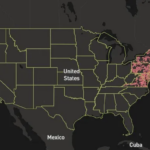

- 5G Deployment: The successful rollout of 5G networks can position AT&T as a leader in the industry, potentially driving AT&T stock higher.

- Fiber Optic Expansion: Investing in fiber optic infrastructure can enhance service quality and attract new customers, positively impacting AT&T stock.

- Cost Management: Efficient cost management and operational efficiency can improve profitability and boost AT&T stock value.

- Investor Sentiment: Market sentiment towards the telecommunications sector and AT&T’s overall reputation can influence investor behavior and AT&T stock price.

Conclusion

AT&T stock is a complex investment influenced by various factors, including industry trends, competitive landscape, economic conditions, and company-specific performance. While the company has a strong market position, investors should conduct thorough research and consider their risk tolerance before making investment decisions. By carefully analyzing AT&T stock and staying updated on industry developments, investors can make informed choices about whether to include it in their portfolios.