Introduction: The 733 Area Code Question – Why So Many People Are Searching For It

Each day, millions of Americans receive phone calls from numbers they do not recognize. A common reaction is to search for the unfamiliar area code, seeking to identify the caller’s location and, by extension, their legitimacy. If such a search has led to this report on the “733 area code,” it is important to state at the outset that this is not a standard area code within the United States telephone system. The very fact that this query is common highlights a significant and growing vulnerability for consumers across the country. The simple act of seeing an unfamiliar number, like one appearing to be from a 733 area code, often serves as the opening move in a sophisticated campaign of fraud and deception.

The telephone network, once a straightforward system where an area code reliably pointed to a specific geographic region, has evolved into a complex, layered infrastructure. This complexity, driven by technological advancements like VoIP, mobile phones, and the sheer demand for new numbers, has created gaps in public understanding—gaps that scammers are exceptionally skilled at exploiting. An unfamiliar number is no longer just a mystery; it is a potential threat.

This report will serve as the definitive guide to the “733 area code” and the critical issues surrounding it. It will begin by unraveling the mystery, providing a clear and direct answer to where the 733 area code is actually located and explaining the technical reasons why the digits “733” might appear in a legitimate United States phone number. From there, the report will pivot to the more urgent topic of consumer protection. It will provide an exhaustive analysis of the most prevalent and damaging phone scams targeting Americans today, with a particular focus on the technology of Caller ID spoofing, which allows criminals to disguise their true location and identity. Finally, this guide will equip every reader with actionable, expert-vetted strategies for identifying scams, resisting psychological pressure tactics, reporting fraud to the proper authorities, and taking immediate steps to mitigate financial damage if they have been victimized. The goal is to transform confusion into clarity and vulnerability into empowerment.

The 733 Area Code Mystery: Uncovering the Truth

The search for the location of the 733 area code stems from a fundamental misunderstanding of the modern telephone numbering system. The number “733” does exist within telecommunications, but its role is more complex than a simple geographic identifier in the United States. The truth involves international dialing plans and the technical structure of domestic phone numbers, a complexity that is often the first layer of confusion that scammers exploit.

The Primary Answer: 733 is a Mexican Area Code for Iguala, Guerrero

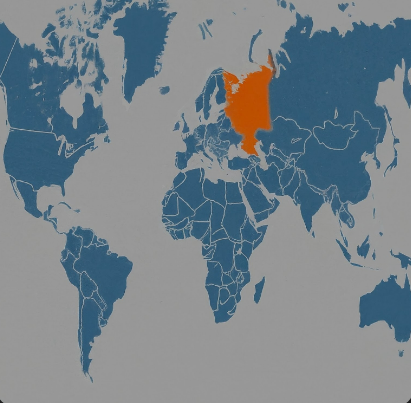

The most direct answer to the query is that 733 is an active telephone area code in Mexico. Specifically, it serves the city of Iguala de la Independencia and its surrounding municipalities in the state of Guerrero. Iguala is a significant city in the region, and its strategic location makes it a hub for commerce and communication. For businesses or individuals in the United States, this international context is the most common reason to encounter a legitimate 733 area code.

A practical understanding of this requires knowledge of international dialing protocols. To place a call from the United States to a number in the 733 area code in Mexico, a specific sequence must be followed:

- Dial the U.S. Exit Code: This is

011, which signals to the network that an international call is being made. - Dial Mexico’s Country Code: The country code for Mexico is

52. - Dial the Full 10-Digit Phone Number: This includes the 3-digit area code (733) followed by the 7-digit local phone number.

Therefore, a complete call from the U.S. to Iguala would be dialed as: 011-52-733-XXX-XXXX.

Furthermore, the globalization of business has led to the rise of virtual phone numbers. Companies can purchase a virtual number with a 733 area code to establish a local presence in Iguala without having a physical office there. These numbers can be forwarded to call centers or offices anywhere in the world, including the United States. This means a U.S.-based company could be using a 733 number for its customer service line for clients in that specific region of Mexico.

The Secondary Answer: 733 as a Central Office Code in the United States

While 733 is not a U.S. area code, the digits “733” frequently appear in legitimate American phone numbers. This is due to the fundamental structure of the North American Numbering Plan (NANP), which governs telephone numbers in the United States, Canada, and parts of the Caribbean.

A standard 10-digit NANP number is formatted as NPA-NXX-XXXX. It is crucial to understand what each part represents:

- NPA (Numbering Plan Area): These are the first three digits, commonly known as the area code. They designate a broad geographic region, such as a state, a portion of a state, or a major city.

- NXX (Central Office Code): These are the middle three digits, often called the prefix or exchange. This code historically pointed to a specific telephone switching center within the larger area code region. Each NXX prefix contains 10,000 possible phone numbers (from 0000 to 9999).

Therefore, when a person sees the number “733” within a U.S. phone number, it is almost certainly the Central Office Code (prefix), not the area code. The actual geographic location is determined by the area code that comes before it. Several areas across the United States use the 733 prefix.

- Texarkana, Texas (Area Code 903): The prefix

903-733is assigned to the Texarkana rate center in Texas. These numbers are primarily associated with wireless carriers, including Cellco Partnership (doing business as Verizon Wireless) and New Cingular Wireless PCS (part of AT&T). - Lafayette, Louisiana (Area Code 337): The prefix

337-733is assigned within the Lafayette, Louisiana, area code. Records indicate its use by carriers such as USA Mobility, which often provides messaging and specialized mobile services. - Lubec, Maine (Area Code 207): The prefix

207-733serves the town of Lubec, Maine. This particular assignment is part of a more complex telecommunications arrangement that has implications for international calling, as detailed below.

Deep Dive: Central Office Code Protection and Cross-Border Calling

The case of Lubec, Maine, provides a fascinating glimpse into the legacy complexities of the telephone network. Lubec is a border community, and making a local call from there to the neighboring Campobello Island in New Brunswick, Canada, has historically been possible with simple seven-digit dialing. Campobello Island is in Canada’s 506 area code.

To preserve this seamless local calling, a policy known as Central Office Code Protection was implemented. The purpose of this policy is to prevent number collisions in communities that straddle area code boundaries. If the prefix “733” were assigned to a location near Campobello within the 506 area code, the network would be unable to distinguish between a local seven-digit call to Lubec (e.g., 733-XXXX) and a local call within New Brunswick.

To solve this, numbering administrators deliberately assign the 506-733 prefix to a location as far away as possible from the border—in this case, Edmundston, New Brunswick. Because Edmundston is a long-distance call from Campobello, it requires dialing the full 10-digit number (506-733-XXXX), thus avoiding any conflict with a seven-digit call to Lubec’s 207-733 numbers.

This kind of technical solution, while clever, highlights a broader issue. Practices like code protection are inefficient, consuming valuable numbering resources at a faster rate. This inefficiency is one of the primary drivers of what is known as “number exhaustion”—the depletion of available prefixes within an area code. This exhaustion, in turn, forces the adoption of measures like overlay area codes and mandatory 10-digit dialing, which further erode the simple, intuitive connection between a phone number and its location. This erosion of reliable geographic signals is precisely the environment in which phone scammers thrive, as it becomes harder for the average person to determine if a call is legitimately local or a spoofed number from across the globe.

Table 1: The “733” Central Office Code in the United States

This table consolidates known assignments of the 733 prefix within the U.S. telephone system, providing a clear reference for identifying the true origin of a phone number containing these digits.

| Area Code (NPA) | Prefix (NXX) | City/Rate Centre | State | Primary Carrier(s) |

| 903 | 733 | Texarkana | TX | Verizon Wireless, AT&T (New Cingular) |

| 337 | 733 | Lafayette | LA | USA Mobility |

| 207 | 733 | Lubec | ME | FairPoint Communications |

The Ultimate Guide to Phone Scams and Caller ID Spoofing

The confusion surrounding numbers like the 733 area code is not merely a matter of trivia; it is a direct contributor to the effectiveness of modern phone scams. When people can no longer trust their own intuition about where a call is coming from, they become more susceptible to the sophisticated social engineering tactics used by criminals. Understanding the primary tool of these scammers—Caller ID spoofing—is the first and most critical step toward self-protection.

The Scammer’s Number One Tool: Understanding Caller ID Spoofing

Caller ID spoofing is the practice of deliberately falsifying the information transmitted to a recipient’s Caller ID display to disguise the identity of the calling party. Using Voice over Internet Protocol (VoIP) technology, scammers can make it appear as though they are calling from any phone number they choose. They can fake a call from a trusted government agency, a local police department, a major corporation, or even a number in the recipient’s own neighborhood—a technique known as “neighbor spoofing”.

The effectiveness of this tactic cannot be overstated. It is designed to bypass the initial layer of skepticism a person naturally has toward an unknown or out-of-state number. When the Caller ID displays “IRS,” “Harris County Sheriff’s Office,” or a local number, the victim is more likely to answer the call and engage with the scammer under the assumption that the call is legitimate.

For this reason, federal authorities have issued clear and repeated warnings. The Federal Communications Commission (FCC) and the Federal Trade Commission (FTC) both advise consumers that Caller ID cannot be trusted. Scammers can and do fake this information routinely. Even if a caller ID shows a real company or agency name and number, it is not proof of the caller’s identity. Any security strategy must begin with this fundamental premise: the information on the screen is not reliable evidence.

Anatomy of a Scam: Common Phone Scams Targeting Americans in 2025

Phone scams are not random; they are well-rehearsed scripts designed to exploit specific human emotions like fear, greed, and empathy. By understanding the most common narratives, individuals can learn to recognize the patterns of manipulation, regardless of the specific number that appears on their Caller ID.

Government Impersonation Scams

This is one of the most terrifying and effective categories of scams. Criminals pose as officials from government agencies to intimidate victims into making immediate payments.

- Law Enforcement Scams: A chilling example involved scammers spoofing the number of the Harris County Sheriff’s Office (713-221-6000). The scammer, using the name of a real (but retired) officer, would inform the victim that they had missed jury duty or failed to respond to a subpoena. They would claim a warrant was out for the victim’s arrest and that the only way to avoid it was to immediately pay thousands of dollars in “bonds” or “fees”. The scam relies on a barrage of legal jargon, citation codes, and the threat of imminent arrest to create panic and prevent the victim from thinking clearly.

- Federal Agency Scams (CBP, IRS, SSA): In a similar vein, scammers pose as agents from U.S. Customs and Border Protection (CBP), claiming a package containing illegal items has been intercepted in the victim’s name. They threaten police involvement unless the victim provides personal information or sends money. The IRS and Social Security Administration (SSA) impersonation scams follow a similar script, threatening arrest or suspension of benefits for unpaid taxes or other fictitious problems. It is a critical fact that real law enforcement and federal agencies will not call to threaten individuals or demand payment over the phone.

The Grandparent or Family Emergency Scam

This scam preys on empathy and love for family. A scammer will call, often late at night, pretending to be a grandchild or other relative. They will claim to be in a crisis—arrested, in a car accident, or hospitalized in another country—and beg the victim to send money immediately for bail, medical bills, or legal fees. They often plead, “please don’t tell my parents,” to create a sense of secrecy and urgency that prevents the victim from verifying the story with other family members. The losses from this emotionally manipulative tactic can range from a few hundred to tens of thousands of dollars.

Utility and Service Provider Scams

In this scenario, a scammer poses as an employee of a local utility company (electric, gas, or water). They will claim the victim’s account is past due and that their service is scheduled for immediate disconnection, often within the hour. The only way to prevent this, they claim, is to make an immediate payment over the phone using a credit card, or more commonly, by purchasing gift cards and providing the numbers. This scam is particularly effective against seniors and small business owners who cannot afford a disruption in service.

Financial Scams (Loans, Credit Cards, Grants)

These scams target individuals in financial need. Scammers will call with an offer for a “pre-approved” or “guaranteed” loan or credit card, often targeting consumers who have recently been turned down by legitimate banks. The catch is that to receive the funds, the victim must first pay an upfront “processing fee,” “insurance,” or “advance payment”. In a similar vein, scammers will claim the victim is eligible for a “free” government grant, ask a few qualifying questions, and then request bank account information to “deposit” the non-existent funds. Legitimate lenders will never ask for an advance fee to secure a loan, and government grants are not awarded via unsolicited phone calls. These keywords—loan, credit, degree—are among the most expensive for advertisers, indicating the high value scammers place on finding victims in these areas.

Prize, Lottery, and Sweepstakes Scams

This classic scam lures victims with the promise of a large prize, such as a new car, a vacation, or a multi-million dollar lottery win. To claim the prize, however, the victim is told they must first pay for taxes, shipping, or insurance fees. Scammers may even send a realistic-looking (but fake) check, instruct the victim to deposit it, and then wire a portion of the money back to cover these fees. The check eventually bounces, but by then, the victim’s wired money is long gone. It is illegal to require a payment to receive a legitimate prize.

The Secret Shopper Scam

Victims are “hired” to be secret shoppers and are sent a large counterfeit check. Their first assignment is to evaluate a wire transfer service like Western Union or MoneyGram. They are instructed to deposit the check, keep a small amount as their “payment,” and wire the majority of the funds to a third party (the scammer). The check is fake, and the victim is left responsible for the full amount withdrawn from their bank account.

Technical Support and “Can You Hear Me?” Scams

In the tech support scam, a caller pretends to be from a major tech company like Microsoft or Apple, claiming a virus has been detected on the victim’s computer. They direct the victim to a website that gives the scammer remote access to their device, where they can steal personal information or install malware. The “Can You Hear Me?” scam is simpler: the scammer asks the question, hoping to record the victim saying “Yes.” This voice signature can then potentially be used to authorize fraudulent charges. The best response to any of these calls is to hang up immediately.

The Psychology of Deception: Pressure Tactics and How to Resist Them

All of these scams, regardless of the specific narrative, rely on a common set of psychological tactics designed to override rational thought. Recognizing these tactics is the key to building a “mental firewall” against fraud.

- Creating Urgency and Fear: Scammers consistently create a sense of crisis that demands immediate action. They will tell victims not to hang up, that they must act now to avoid arrest, prevent a service disconnection, or claim a limited-time prize. This pressure is designed to prevent the victim from taking a moment to think, consult with others, or verify the caller’s claims.

- Insisting on Illegitimate Payment Methods: This is the single most reliable red flag of a scam. Scammers direct their victims to pay using methods that are difficult to trace and nearly impossible to reverse. Any request for payment via gift cards (Apple, Google Play, Steam), wire transfers (Western Union, MoneyGram), cryptocurrency (Bitcoin), or peer-to-peer payment apps (Zelle, Venmo) is a guaranteed scam. Legitimate businesses and government agencies will never demand payment through these channels.

- Information Phishing Under False Pretenses: Scammers will often ask a victim to “confirm” or “verify” personal information they should already have, such as a Social Security number, date of birth, bank account number, or password. This is a phishing attempt to steal sensitive data for identity theft. A legitimate organization will not call unexpectedly to ask for this information.

Table 2: Common Phone Scams and Their Red Flags

This table provides a quick diagnostic tool to help identify common scam narratives and their universal warning signs.

| Scam Name | The Lie (The Story They Tell) | The Demand (What They Want) | The Reality (The Truth) |

| Law Enforcement Impersonation | “You missed jury duty/a subpoena. A warrant is out for your arrest.” | Pay a bond or fine immediately via gift card, wire transfer, or crypto to avoid arrest. | Law enforcement does not call to demand payment over the phone for fines or warrants. |

| Grandparent/Family Emergency | “I’m your grandchild. I’ve been arrested/in an accident and need money now. Don’t tell anyone.” | Wire money or provide gift card numbers for bail, hospital bills, or legal fees. | A tactic to create emotional panic and prevent verification. Always verify with other family members. |

| Utility Service Threat | “Your electric/gas bill is overdue. Your service will be shut off in 30 minutes if you don’t pay.” | Immediate payment via credit card, payment app, or gift card. | Utility companies provide multiple written notices before disconnection and do not demand payment by gift card. |

| Guaranteed Loan/Credit Card | “You are pre-approved for a loan/credit card, even with bad credit.” | Pay an upfront “processing fee” or “insurance” to receive the funds. | It is illegal for legitimate lenders to ask for an advance fee to secure a loan or credit. |

| Lottery/Prize Winner | “Congratulations! You’ve won a million dollars/a new car in our sweepstakes.” | Pay taxes or shipping fees via wire transfer or gift card to claim your prize. | Legitimate prizes do not require any form of payment from the winner. |

| Tech Support Alert | “We’ve detected a virus on your computer. We need to access it to fix the problem.” | Give remote access to your computer and/or pay for fraudulent tech support services. | Tech companies do not make unsolicited calls about viruses on your personal devices. |

Taking Action: Your Guide to Reporting Scams and Protecting Your Finances

Recognizing a scam is the first step, but knowing how to react—both in the moment and after the fact—is what truly protects consumers. For those who have been targeted or have fallen victim, there is a clear set of actions to take to report the crime and attempt to recover lost funds. The system for recourse is fragmented, placing the burden of action squarely on the consumer, which makes having a clear, consolidated guide essential.

Your First Line of Defense: How to Handle a Suspected Scam Call

The most effective way to deal with a scam call is to prevent the scammer from ever engaging. A simple, disciplined approach to answering the phone is the strongest defense.

- Don’t Answer Calls from Unknown Numbers: If the number is not in one’s contacts, it is safest to let the call go to voicemail. A legitimate caller will leave a message.

- Hang Up Immediately: If a call from an unknown number is answered by mistake, hang up as soon as it becomes clear it is a robocall or an unsolicited sales pitch. Do not speak or interact.

- Never Press Any Buttons: Scammers often use prompts like “Press 1 to be removed from our list.” This is a trick to identify a live, active number, which will only lead to more scam calls. The correct action is to hang up.

- Do Not Respond to Questions, Especially with “Yes”: Avoid answering any questions, particularly simple ones that could elicit a “Yes” response. Scammers may record this to use as a voice signature for fraudulent authorizations.

Fighting Back: How and Where to Report Phone Scams

Reporting scams is a critical civic duty. While it may not lead to the immediate recovery of funds, the data provided to federal agencies is essential for tracking trends, identifying criminals, and building enforcement actions on a national scale.

- Federal Trade Commission (FTC): The FTC is the primary federal agency responsible for collecting reports on scams, fraud, and identity theft. Reporting a scam to the FTC is the most important step. Complaints can be filed easily online at ReportFraud.ftc.gov.

- Federal Communications Commission (FCC): The FCC handles complaints related to the telecommunications infrastructure itself, including unwanted calls, robocalls, and Caller ID spoofing. Filing a complaint helps the FCC track violations of telecommunications law. Complaints can be filed at the FCC Consumer Complaint Center online.

- National Do Not Call Registry: Registering a phone number on the National Do Not Call Registry will reduce calls from legitimate telemarketers. It is important to understand that this registry will not stop calls from illegal scammers, as they do not follow the law. However, by reducing the volume of legitimate sales calls, it can make it easier to identify the fraudulent ones. Registration is free online at DoNotCall.gov or by calling 1-888-382-1222.

- State and Local Agencies: It is also advisable to report scams to the consumer protection division of one’s state Attorney General’s office. In cases involving impersonation of local law enforcement, a report should also be filed with the relevant police or sheriff’s department.

Damage Control: What to Do If You’ve Already Paid a Scammer

For those who have been victimized and sent money, time is of the essence. The chances of recovery are often slim, but immediate action can sometimes make a difference. The correct course of action depends entirely on the payment method used.

- Paid with a Credit or Debit Card: Immediately contact the bank or card issuer using the number on the back of the card. Report the charge as fraudulent and ask them to perform a “chargeback” to reverse the transaction and refund the money.

- Sent a Wire Transfer (e.g., Western Union, MoneyGram): Contact the wire transfer company’s fraud department immediately. Provide the transaction number, amount, and recipient information. Ask them to reverse the transfer if it has not yet been picked up.

- MoneyGram: 1-800-926-9400

- Western Union: 1-800-448-1492

- Paid with Gift Cards: This is one of the most difficult situations to remedy. Immediately contact the company that issued the gift card (e.g., Apple, Google, Target). Report that the card was used in a scam and ask if any remaining funds can be frozen or refunded. Keep the physical card and the store receipt as evidence.

- Used a Payment App (e.g., Zelle, Venmo, Cash App): Report the fraudulent transaction to the payment app’s support team immediately. Additionally, if the app is linked to a credit or debit card, report the fraud to the bank or card issuer and request a reversal of the charge.

- Paid with Cryptocurrency: Contact the cryptocurrency exchange or platform used to send the funds. Report the transaction as fraudulent. While crypto transactions are typically irreversible, reporting the scam can help the platform identify and block the scammer’s wallet address.

In all cases, after contacting the financial institutions, a report should be filed with the FTC at ReportFraud.ftc.gov. This creates an official record of the crime that can be used for law enforcement purposes.

Table 3: How to Report Phone Fraud and Scams

This reference table provides direct links and contact information for the key agencies involved in consumer protection.

| Agency/Registry | Purpose | How to Report |

| Federal Trade Commission (FTC) | Primary agency for reporting all types of fraud, scams, and identity theft. | Online: ReportFraud.ftc.gov |

| Federal Communications Commission (FCC) | For reporting unwanted calls, robocalls, text spam, and Caller ID spoofing. | Online: consumercomplaints.fcc.gov |

| National Do Not Call Registry | To reduce calls from legitimate telemarketers. (Will not stop illegal scammers). | Online: DoNotCall.gov Phone: 1-888-382-1222 |

| State Attorney General | For reporting violations of state consumer protection laws. | Online: Search for ” Attorney General Consumer Complaint” |

Understanding the Technology: How Your Phone System Works

A deeper understanding of the telecommunications infrastructure itself can provide valuable context for why the phone system operates the way it does and why certain vulnerabilities exist. The system is a complex patchwork of legacy technologies and modern innovations, which has moved it far from the simple, geographically-based network of the past.

The Blueprint: The North American Numbering Plan (NANP)

The North American Numbering Plan (NANP) is the integrated telephone numbering system for 20 countries in North America, including the United States, Canada, Bermuda, and many Caribbean nations. It is the reason a call from New York to Los Angeles is dialed in the same format as a call from Chicago to Toronto. The plan is administered by the North American Numbering Plan Administrator (NANPA), under the oversight of regulatory bodies like the FCC in the United States. The NANP’s structure is what defines area codes (NPAs) and central office codes (NXXs), and NANPA is responsible for allocating these resources to service providers.

Not All Numbers Are Created Equal: Geographic vs. Non-Geographic Numbers

One of the most significant sources of confusion for consumers is the proliferation of numbers that are not tied to a specific geographic location. The traditional model of a “geographic number,” where an area code like 212 clearly points to Manhattan, is no longer the only model in use.

- Non-Geographic Numbers are telephone numbers that are associated with a country but not a specific city or locality within it. They are virtual and can be routed to any phone line, anywhere in the world. This category includes several types of numbers that are now commonplace:

- Toll-Free Codes: In the NANP, these are numbers that are free for the calling party to dial. They are identified by distinct, non-geographic area codes: 800, 888, 877, 866, 855, 844, and 833. Businesses use these numbers to encourage customer inquiries by removing the cost barrier.

- Special N11 Codes: These are three-digit codes reserved for specific public services. They are easy to remember and uniform across the country. Key examples include 911 (Emergency Services), 411 (Directory Assistance), 811 (Call Before You Dig – Utility Location Services), and 988 (National Suicide & Crisis Lifeline).

- Business and Shared-Cost Numbers: While more common in other countries like the United Kingdom (with prefixes like 03 or 0845), the concept of a national number for a business that is not toll-free is a major part of global telecommunications. These numbers give a business a nationwide presence without needing offices in every city.

The Future of Area Codes: Overlays and Number Exhaustion

The explosion in demand for phone numbers—driven by cell phones, VoIP lines, and IoT devices—has led to a phenomenon called number exhaustion, where an area code runs out of available three-digit prefixes. To solve this, administrators have two primary options:

- Geographic Split: The region is split in two, with one part keeping the old area code and the other getting a new one. This was the traditional method but is highly disruptive to residents and businesses in the new area code.

- Overlay Plan: A new area code is introduced to the same geographic area as the existing one. New phone lines are assigned numbers from the new overlay code, while existing numbers remain unchanged.

Overlay plans are now the standard solution. For example, as the 512 area code in Austin, Texas, began to run out of numbers, the 737 area code was introduced as an overlay. A major consequence of an overlay is that it breaks seven-digit dialing. Since two different area codes now serve the same local area, all local calls must be dialed with all 10 digits (area code + number) to avoid confusion. This change, while necessary, further detaches the public’s understanding from the reality of the network. A neighbor might have a completely different area code, and the simple act of dialing a local number becomes more complex.

This entire journey—from the simple question of a “733 area code” to the complexities of international dialing, Central Office Code Protection, number exhaustion, and non-geographic overlays—paints a clear picture. The telecommunications network is no longer an intuitive system. It is a highly technical, constantly evolving infrastructure with layers of legacy rules and modern patches. This complexity is not a flaw but a feature of its growth. However, it creates a significant knowledge gap for the average user. It is this gap that makes consumer education not just helpful, but the single most powerful tool for fraud prevention. Since the system itself cannot be simplified, the user’s understanding of it must be enhanced. By learning to distrust Caller ID, recognize the psychological patterns of scams, and understand the basic structure of the network, individuals can navigate the modern communication landscape with confidence and security.